by Pi Accountancy | Nov 23, 2023 | Business

The 2023 Autumn Statement brings substantial financial changes that effects everyone from employees and employers to pensioners. This is Pi Accountancy’s overview geared to unpack the key sections that could affect our clients. Read the full documentation here:...

by Pi Accountancy | May 3, 2023 | Business, HMRC

Anti-Money Laundering Regulations Overview – AML Compliance – AML Checks – AML Solutions and Compliance Review – MLR-Applicable Businesses – Supervisory Bodies – Additional Guidance and Resources Overview Money...

by Pi Accountancy | Apr 27, 2023 | Business, Director

Owner’s Equity Owner’s equity, also know as shareholders’ equity, represents the residual interest in the assets of a company after deducting it’s liabilities. In real words, it is the portion of a company’s assets that belongs to the...

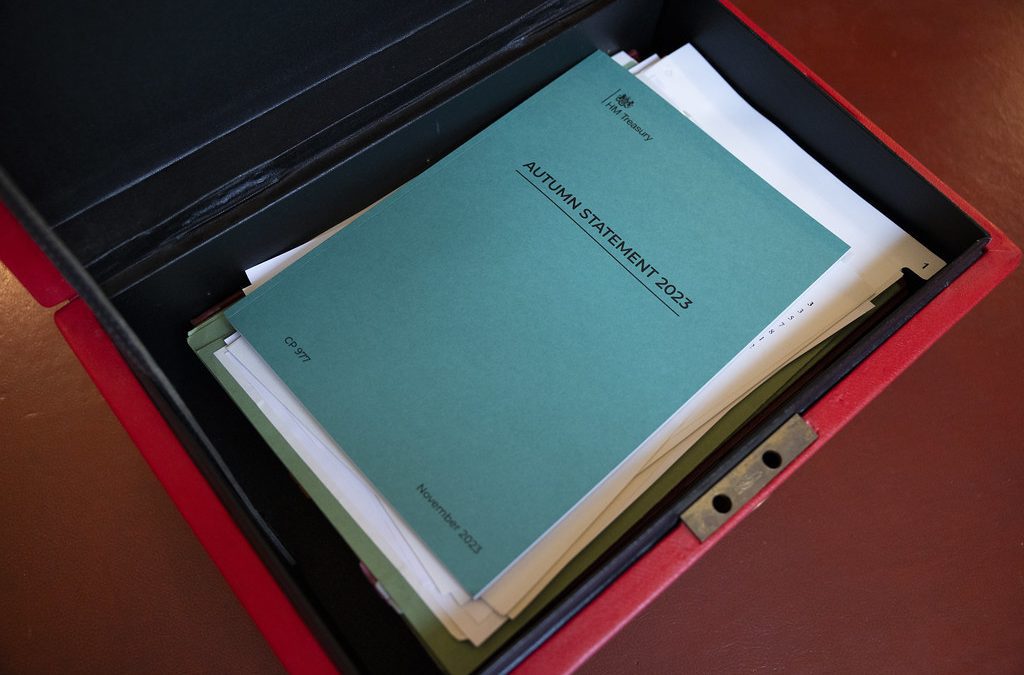

by Pi Accountancy | Apr 6, 2023 | Business, Director, HMRC, Self-Employed, Taxes

Happy New Tax Year! As of today, the new UK tax year has officially started. It’s time to get your finances in order, review your tax code and start planning for the year ahead. Whether you’re self-employed, employed or a business owner, this is the...

by Pi Accountancy | Mar 31, 2023 | Business, Corporation Tax, Property Landlords, Taxes

The ISA Allowance has been frozen for 2023/24 The annual Investment Savings Account (ISA) allowance has been frozen once again for the 2023/24 tax year. By freezing it again, the allowance is being left at £20,000 for every individual – However there will be an...

by Pi Accountancy | Mar 21, 2023 | Business, Corporation Tax, Director, HMRC, MTD, Self-Employed, Taxes, VAT

Key Tax Changes for the 2023/24 Tax Year We’re here to inform you about the Key Tax Changes for the 2023/24 Tax year and how these changes will affect companies, as well as sole traders. National Insurance The introduction of the new “Health and Social...